|

Looking out from Hell Town tonight... |

|

| Settled in 1800s, incorporated in 1844. Built on the Blackwater River near a timber mill, and called "Mill Town." Also "Scratch Ankle,” for the briars growing along the riverbank; Also "Hard Scrabble," (one can only guess); "Jernigan’s Landing,” for a founder; and "Hell Town," for its "muggy, inhospitable land covered with briars, mosquitos, thorns and snakes." Today Milton, in Florida's western Panhandle, is the Santa Rosa County seat. Retreating Confederate forces burned it in 1862. Burned again in 1885 and 1892, both fires torching Milton's commercial establishments. Yet another, even bigger fire in 1909 razed almost every building within two blocks of the river, including the Town Hall. Other than that, little has changed over time. But getting ready to. Getting ready. | |

Gallup Wkly: 44% - 1/15/20)

| Tax Reform Scorecard | IV Q 17 (baseline) |

I Q 18 | II Q 18 | III Q 18 | IV Q 18 | I Q 19 | II Q 19 | III Q 19 |

|---|---|---|---|---|---|---|---|---|

| Priv Sect Emp (000) |

125,294 | 125,904 | 126,571 | 127,094 | 127,858 | 128,297 | 128,723 |

129,081 129,081+358 (0.3%) ! |

| Priv Sect Wages ($, wkly avg.) |

919.08 | 924.60 | 930.81 | 939.78 | 948.06 | 955.65 | 959.76 |

966.30 966.30+6.54 (0.7%) ! |

| GDP ** |

18,223.8 | 18,324.0 | 18,511.6 | 18,732.7 | 18,783.5 | 18,927.3 | 19,021.9 |

19,112.5 19,112.5+90.7 (0.48%) |

| Non-Res Fixed Inv ** |

2,582.7 | 2,654.0 | 2,689.9 | 2,703.9 | 2,735.8 | 2,765.6 | 2,758.5 |

2,737.8 2,737.8-20.70

(-0.75%) |

|

Fed Receipts

$ (bil.)

|

770 | 732 | 1,046† | 771 | 787 | 739 | 1,099† |

853 853+83 (+10.8%)

|

|

Deficit

$ (bil.)

|

-225 | -373 |

-9 |

-288 | -317 | -376 | -746 |

-984 -984238 worse

|

10/30/19 -- Faster, Pussycat! Kill! Kill!

|

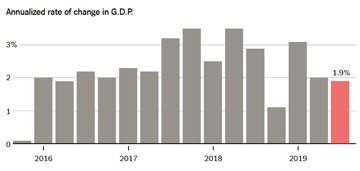

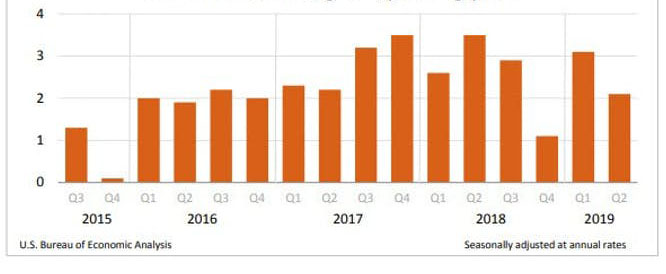

The White House is being uncharacteristically mum about the Bureau of Economic Analysis's announcement of 1.9% GDP growth (annualized) for the third quarter. Actually the figure beat expectations. The New York Times noted a 3% drop in business investment, and spending on factories and offices sank by 15.3%. Trade and a deteriorating global outlook were also a drag on the quarter. Exports rose by 0.7%, but Imports, a subtraction in the calculation of GDP, increased by 1.2%. But The Times dutifully reported that analysts believe the economy remains rooted in solid ground. “If I saw cracks in the consumer sector, I would be worried, but I don’t see that yet,” it quoted Ben Herzon, executive director of United States economics at the forecasting firm Macroeconomic Advisers as saying. Third Quarter GDP: "Soft Landing"

Consumer spending comprises about two-thirds of US GDP, and while PCE (personal consumption expenditures) slowed in the third quarter, the sector still grew at an annualized rate of 2.9% (compared with 4.6% in the second quarter). So the general feeling among those who follow these numbers is that no recession is in the near offing. Then again, maybe the consumer is just the last guy in the room to get the joke. Market Watch opined that CEOs and small-business owners cut back on hiring and investment in the third quarter and are more hesitant to make big plans until trade disputes are resolved and the global picture brightens.. Where the third quarter GDP figure did come up short was against the president’s bold prediction (December 2017) of "4%, 5%, and even 6%" growth driven by his corporate and high-earner tax cuts, deregulation efforts and a rather confrontational trade negotiating posture. |

Other posts on this page ...

Off the hook, more or less. "Who're you gonna believe: me or your lying eyes."

"And before you know just where you are you're in an Irish pub."

In search of a plausible rationale

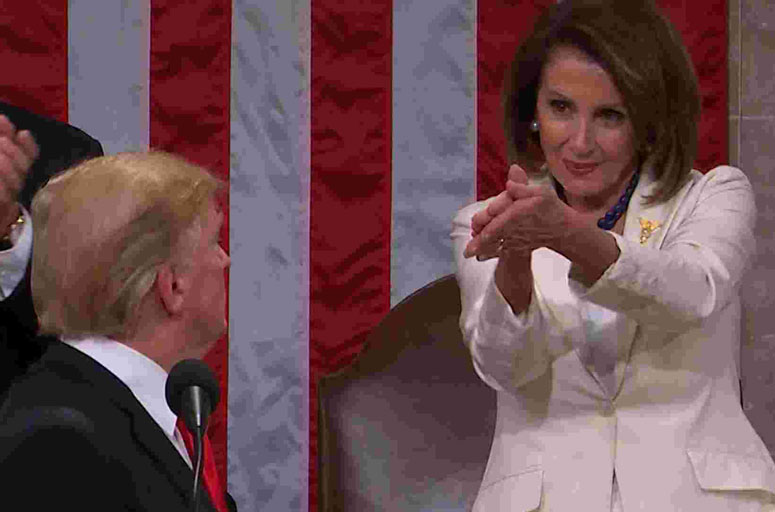

The State of the Union. "Much, much better than new."

Last July, a White House mid-session budget review foresaw GDP reaching 3.2% this year and staying at or above the 3% mark for the next five years. That plan is probably moot. But it was always a more optimistic target than other forecasters would be likely to suggest. The thinking of most economists is that somewhere more like 2% growth is what would be sustainable for such a large and mature economy as ours over the long haul. The Economist magazine has been projecting a 2.2% annual growth rate for the U.S. since the beginning of the year. The Donald needs to read more.

Increased government spending also contributed to the latest GDP results, rising 3.4% over the second quarter. You'll have to decide for yourself whether that's a good thing or a bad thing. After the Commerce announcement, the Federal Reserve cut interest rates by a quarter percentage point in a bid to spur more growth. but hinted that there might not be any more interest rate cuts on the horizon. |

He said ... She said ...

On the site A Wealth of Common Sense, Ben Carlson, Director of Institutional Asset Management at Ritholtz Wealth Management and author, lets more air out of the Trump boast. Carlson cites statistics from the book It Was a Very Good Year, by Martin Fridson, showing the ten best years in stock market history (for the Dow) going back to the year 1900.

| Year | Gain |

|---|---|

| 1933 | 53.97% |

| 1954 | 52.62% |

| 1915 | 50.54% |

| 1935 | 47.66% |

| 1908 | 45.78% |

| 1928 | 43.61% |

| 1958 | 43.37% |

| 1927 | 37.48% |

| 1975 | 37.21% |

| 1995 | 36.89% |

Carlson adds that Fridson’s book was published in 1997, and since then the Dow has seen gains of 28.0% (2003), 22.5% (2009), 29.4% (2013) and 28.0% (2017). Nothing good enough to crack the top 10.

On the financial-planning.com site, Allan S. Roth reported in January 2019, "U.S. stocks gained 21% for the first two years of the Trump administration. That translates to a 10% annual return, which is 0.5 percentage points above the long-run average. By comparison, U.S. stocks gained 71.2% in the first two years of the Obama administration, and the 30.8% annualized return bested the historical average by 21.3 percentage points."

9/2/19 -- "In the Big Rock Candy Mountains";

|

Slower growth in second-quarter GDP figures didn't draw much scrutiny when the numbers were released recently, which was surprising. There was a lot of news behind that news. US economic growth was down to 2.1%, compared to 3.1% in the first quarter, which was better than many thought it would be. There were predictions it would come in under 2%, but strong consumer and federal government spending buoyed the figure up. Major drags were downturns in inventory investment, exports (quel surprise), and nonresidential fixed investment. These were partly offset by accelerations in PCE and federal government spending.

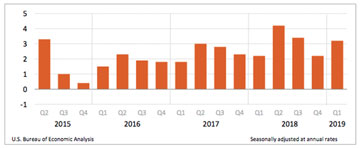

Real GDP: Percent change from preceding quarter

Whither? Trump thought over 4% was within easy reach. The Economist predicts 2.2% for the year. But for the moment, at least, the year is off to a good start.

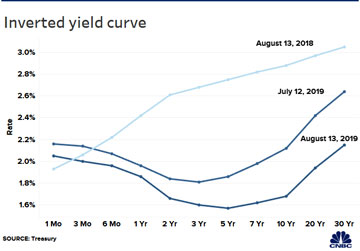

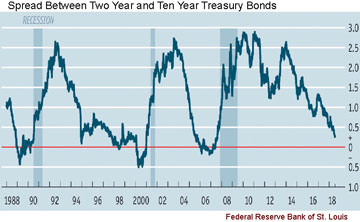

In that same report, the Commerce department released a bunch of adjustments as part of a revision effort to GDP data going back to 2014. Those revealed that, among other things, last year’s economic growth fell short of earlier reports as well as metrics the Trump administration had targeted in its 2018 budget, robbing the president of some much favored bragging points. The Commerce Department initially estimated that GDP rose 3.1% in the fourth quarter of 2018 from the same period of 2017. The figure was revised first down to 3%, and then down to 2.5%. The economy has grown 2.3% a year on average through this expansion, but President Trump promised to boost the rate to 3% or more through his policies of tax cuts, deregulation and a tougher trade stance. Earlier this year, Republicans lauded the 3.1% fourth-quarter '17- to- fourth-quarter '18 growth figure as the strongest in more than a decade and evidence that the tax overhaul bill passed December 2017 was working. The revisions released Friday show instead that the economy grew faster, at 2.8%, in the fourth quarter of 2017 from the same period of 2016, than the 2.5% rate clocked by the same measure a year later. The department’s revisions also adjusted the picture of recent economic performance in a number of other ways. For example, the economy grew more slowly than previously reported in the second quarter of 2018, at a 3.5% annual rate rather than 4.2%. That was largely due to weaker investment in structures and lower exports than thought. Growth was also slower than previously reported for the fourth quarter of 2018 due to updated figures on consumer spending and business investment. The pace of economic growth was revised to a 1.1% annual rate, or half the 2.2% pace estimated before and the weakest quarterly rate in three years. The New York Times reported that residential investment, which includes housing construction, declined for the sixth consecutive quarter. Business investment also declined, and exports slumped as manufacturers in particular were battered by tariffs and slowing demand from overseas. With recent news banners on the "inverted yield curve," however short lived, pundits began to pile onto the "here-comes–the-recession" bandwagon. On August 14, in its worst loss of the year, the DOW dropped 800 pts. Investors were fleeing equities for higher ground. So what the hell is an inverted yield curve? Long term rates (i.e., 10-year treasury notes) should pay higher return than short term rates (i.e., 2-year treasury notes). Because your money's tied up longer. Even if the only fixed rate investment you've ever owned was a CD or a passbook savings account back somewhere in your long lost youth, you know that's not supposed to happen. But it IS what happens when people lose their faith in the future and don't what to commit to tying up their money for fear of locking in future losses. Less risky to stay flexible and see where things might be going. That's the kind of action that drives short-term prices down. The DOW closed Aug 14 at 25,478. Aug 23 it closed at 25,628.90 even after losing 600 points on the day for a different reason. So most of the trading for that 9-day period was just a bunch of rich guys pulling cash out of one pocket and stuffing it in another. Much of that trading was probably done automatically by computer trading programs. Machines can lose money much faster than even the smartest smart guys can. And reverse course quicker when somebody realizes they've bid prices down far enough to create a new buying opportunity. By Labor Day your 401k is probably going to be right about where it was on August. 13. Even the usually clear-eyed Charles Krugman climbed on board the inverted yield curve train. Well, sort of, anyway. He went on to clarify his thoughts in a later column. "Neither I nor anyone else is predicting a replay of the 2008 crisis. It’s not even clear whether we’re heading for recession. But the bond market is telling us that the smart money has become very gloomy about the economy’s prospects." Which sounds about right. GDP is what calls a recession. Two consecutive quarters of negative growth. Our economic growth rate is down -- and Trump's ham-fisted grasp of economic policy has surely played a part – but we're hardly out. 2.1 growth is nothing to sneeze at. For all the administration's missteps, the economy seems resolutely impervious to their self-flagellations.

If spring is here, can summer be far behind?

Leading up to the 2008 derivatives meltdown, an inverted yield curve first appeared in August 2006, when the Fed raised short-term interest rates in response to overheating equity, real estate and mortgage markets. That inversion preceded the peak of the Standard & Poor’s 500 in October 2007 by 14 months and the official start of the recession in December 2007 by 16 months. Since 1956, equities have peaked six times after the start of an inversion, and the economy has fallen into recession within seven to 24 months. It's not like recessions are the instantaneous result of rate inversions. Moreover, the former are not directly caused by the latter. Nor does the flight from equities by investors launch a recession. It's the other way around. These are merely signposts that show up somewhere along the way indicating that big money is losing faith in the future endurance of the economic engine they're perched carefully upon. |

President Trump got unhappy with the fourth estate for doting on the recently spotlighted inverted yield curve and the ensuing equities sell off and even positing the possibility of an impending recession. And countered by doubling down on a longstanding brag about the historical economic miracle he has pulled off, "the greatest economy in our history." And a brag, indeed, it is. Still, there's evidence much of the public still take him seriously. In a couple of recent polls 49% of respondents credited the President for his management of the economy. These people have no idea that the even the best of presidents have little control over the direction or progress of the economy.

So what makes people so sure?

Are some of these the same people who gave President Obama so little credit for his management of the post-recession turnaround. But why such deference toward someone who has so little idea of what he is doing and even less of how things economic even work in the real world? 49%. This is like crediting a man who's been dealt four aces with being a good poker player. By now most readers are probably paying little attention to this website's "Tax Reform Scorecard" header ( that box at the top of the page), which has kept a running quarterly tally of economic progress following the Corporate and Rich Person Tax Largesse Act passed at the end of 2017. Many of you probably still don't know how to read the scorecard and it probably hurts to try. Pity. The graphic demonstrates in clear fashion how little key economic metrics (all of which most of you can grasp at least fundamentally) have moved in response to that legislation. Indeed how slowly those numbers could ever change under almost any conditions. It's worth one more careful, look before you die. Or otherwise just lose interest in such things forever.

So it's not the our greatest economy (by a long shot) but a good economy just the same. The gloomy signals doubters are pointing out augur for something that might be somewhat down the road. Might the global economy go into recession eventually? Europe, China and elsewhere in Asia are slowing. Germany is probably already in a recession. Might a global slowdown take us with it? The question calls to mind the joke about the travelling salesman asking a Maine farmer if he thought the teeming downpour mercilessly drenching them both was ever going to stop. "Always has," was the farmer's dry reply. With good employment numbers and a lot of pent up energy in the consumer sector, and with a big-spending federal government as well, the US economy is in better shape than most to weather a storm even if the global situation does fall back. But we haven't seen our last period of negative growth in this country. Some day recession will return. It always has. The economy is cyclical. Might we take a bigger hit than we think? Than we needed to? Sure. Look who's flying the plane. But right now, we're slowing, not stalling. Certainly not crashing.

Boy you sure took me for one big ride

Even now I sit and wonder why And when I think of you I start myself to cry I just can't waste my time, I must keep dry Gotta stop believin' in all your lies 'Cause there's too much to do before I die, hey You feelin' alright? I'm not feelin' too good myself You feelin' alright? I'm not feelin' too good myself. Dave Mason

|

5/7/19 -- "Made It, Ma! Top of the World!"

|

Following "complete and total exoneration" by the Mueller report, or at least the Cliffs Notes version thereof, President Trump appears to be feeling shiny as a newly minted dime. The inner turmoil and vexation that had informed many recent public tweets and private lamentations? Washed thoroughly away by Barr's simple absolution. “ It’s never taken me 400

pages to say 'nothing happened.' ” Former Federal Prosecutor Chuck Rosenburg's reaction to Attorney General Barr's four-page summation of the Mueller Report

The president shows renewed enthusiasm for revisiting many of his half-baked notions of the past. And is even coming up with some new ones. For the children at the southern border? Lock 'em up, or better yet, send them to San Francisco. For the military? More money, of course, but maybe some invasions. Venezuela maybe. Or Iran. For the worthless poor? Not a sou. Time to balance the budget. He wants to unleash his Justice Department on his own courts to rid himself of the pesky health care legacy of his predecessor. With help from Senate Majority Leader Mitch McConnell, he's now cleared to put the kind of partisans and dolts on the federal bench and at the Federal Reserve that our country deserves and has for too long been denied. Basically, Trump insists he aced the Russian investigation, as he always claimed he would — he now wants the FBI investigators themselves investigated for investigating him in the first place, and may just get his wish. And whatever his real grade was, he's pushing to make sure no one ever gets to see it, and he may even get that wish too. As for his tax returns, well, fuggetabout it. And the public has taken notice, and is impressed. Trump's monthly Gallup approval rating soared to 45%, an all-time high, after the Barr verdict. And his most effective tormentor in the public arena, lawyer Michael Avenati, has been indicted and is facing centuries in jail for extortion. How lucky can one boy be? Maybe Sun Tzu was right. "If you wait by the river long enough, the bodies of your enemies will float by." And Hillary's too if he gets really lucky.

663highland, via Wikimedia Commons

Sun Tsu, 544–496 BC, author of The Art of War, an ancient Chinese military treatise. Although the quote might not really be his. Certainly, inconsistent with the spirit of the book, which might not really be his either. No matter, Trump hardly has time to wait anyway.

Trump's revivified spirit calls to mind the mild case of overconfidence George W. Bush fell prey to after his 2004 reelection. It was a tight 4-point win, but he read it as a landslide and a mandate as well. Bush said he'd earned political capital in the election and was intending to spend it. And spend he did, although not as he might have intended. He decided the right place to start was with privatizing social security. He wanted to turn it into an investment club and made it his top domestic priority. No offense intended, but how like a rich kid to not know the difference between insurance and playing the market. He pitched it hard in his 2005 State of the Union Address. He launched an initiative (directed by Karl Rove) to mobilize public support. Then he embarked on a series of touring events to try to sell privatizationn to the public, which at the time was pretty much evenly split on the idea. The more he talked, the more the public mood soured. By Gallup's reckoning, public disapproval of the president's handling of Social Security grew by 16 points, from 48% to 64%, between the State of the Union address and June 2005. Then came Katrina. The government’s inept response to 2005's monster hurricane, at the time the costliest natural disaster in U.S. history, made President Bush look, to put it charitably, out of touch. Ten days after Bush publicly praised FEMA head Michael Brown for his handling of the crisis ("Brownie, you're doing a heck of a job."), Brown resigned amid a public uproar over his qualifications (former Horse Association Commissioner) and the administration's failure to get very much actual aid of any kind into New Orleans. News outlets were broadcasting reports of bodies floating in the streets and pandemonium among some 30,000 refugees stranded in the Superdome without lights, food or air conditioning. All the while, the Iraq War was looking increasingly like a bad idea in the face of mounting American causalities and a growing Iraqi insurgency. Then came an untimely series of scandals and embarrassing news reports involving Republican politicians, which further undermined the Administration's support. In February 2006, vice president Dick Cheney accidentally shot Harry Whittington, a 78-year-old Texas attorney, in the face with a shotgun while on a quail hunt on a ranch in Texas. In late September a Republican congressman was forced to resign after accusations surfaced he was exchanging sexually suggestive e-mails and instant messages with teenaged boys who had formerly served as congressional pages. The 2006 midterm elections were a disaster for President Bush and his party. They lost control of both houses of Congress and a majority of governorships across the nation. Bush’s legislative agenda never recovered.

2006 mid-terms: end of the trail. For the first time since the creation of the Republican party in 1854, no Republican captured any House, Senate, or Gubernatorial seat previously held by a Democrat. Will history repeat itself? Or will Trump surprise again?

The hits kept on coming. In 2007, Vice President Cheney’s former chief of staff, Lewis "Scooter" Libby was convicted of lying and obstructing justice in an investigation into who leaked the name of the former covert CIA operative Valerie Plame to the public. Later that same month, it was revealed that the Justice Department had fired eight US attorneys, ostensibly for incompetence. Critics alleged that the real reason was to put more ideological Bush loyalists in place. A 2008 investigation at the Department of the Interior revealed allegations of financial self-dealing and accepting gifts from energy companies. Female staffers were using cocaine and marijuana at industry functions and engaging in sexual misconduct with oil and gas company lobbyists. Finally, of course, there was the financial meltdown in the summer of 2008. At the peak of his popularity, right after 9/11, Bush had the highest approval rating of any president in Gallup's history of recordkeeping. He left Washington in 2009 with an approval rating of 33%, one of the lowest. A big difference between Bush and Trump is that the latter's sugar high is coming a year and a half before his second term even begins, assuming he gets one. What kind of emerging trouble could this new burst of self-confidence be blinding him to? Several of his planned initiatives seem fraught with potential peril. Stamping out Obamacare remains one of the president's primal urges. Health care is the issue many Republicans blame for their poor showing in the 2016 mid-terms, yet Trump seems determined to embroil them right back in it, still with no coherent alternative on offer. He is itching to take it on again, even though Mitch McConnell is loathe to scratch it. The president remains convinced the border remains a winning issue for him, even though his actions to date seem to have done little but exacerbate the problem. Moreover, it seems impossible to see how any solution to the growing numbers of asylum seekers from El Salvador, Guatemala, and Honduras can succeed that doesn't in some way address the deplorable living conditions in those countries. Which is a problem Washington has traditionally seemed shy about engaging with and has sometimes even worked at cross purposes to. ( See Harper's,"The Truce," May 2019. Access may be restricted.) |

These are some of the most violent countries in the world, sporting some of the highest homicide rates. Refugees are betting their lives, their livelihoods and their safety to seek asylum here. Can treating them badly possibly succeed in dissuading them? Trump is counting on the economy to stay strong for him through the election, and he continues to get high marks (56% approval) for his management of it. (Which frankly seems more like a case of right place, right time than anything else, but that's not the way the public sees it.) First quarter GDP registered a surprising 3.2% increase over the previous quarter, even with the government shut down during the first month of the year. (Government spending accounts for almost 40% of GDP.) Unquestionably the 2017 tax cuts juiced the GDP with some extra cash for a couple of quarters (even though the largesse was skewed largely toward corporate friends and wealthy supporters (at the latter's insistence). And job growth remains strong for the moment. But the economy is a funny thing. First quarter GDP was a half point higher than the Atlanta Fed's pretty reliable "GDP Now" model had projected. Forbes points out that trade, inventories and government spending contributed a combined 2.1% of that 3.2% total. Forbes goes on to note, "Since trade has been a drag on growth for five years, inventories tend to balance themselves out fairly quickly and government spending is being boosted by larger deficits, the core economy of consumer spending and business investment grew at only a 1.1% rate."

Real GDP: Percent change from preceding quarter

Whither? Trump thought over 4% was within easy reach. The Economist predicts 2.2% for the year. But for the moment, at least, the year is off to a good start.

If, as expected, growth should slow in coming quarters, the president would have little to show for his tax cut strategy but a wildly mushrooming deficit and some memories. Consumer confidence shows signs of flattening, and nobody but the direct beneficiaries noted above has anything good to say about the Republicans' "tax reform" anymore. The premature victory lap over the Barr memo notwithstanding, Trump's legal and ethical problems are hardly things of the past. Attorney General Barr's handling of the Mueller report is seen as untowardly partisan. The House of Representatives appears headed towards a death match with the president concerning differing opinions about congressional oversight. No man blusters his way better through seemingly unending crisis parades than Donald Trump, but can this really go on forever? Can he really stay at war with muitifarious investigating agents in the House, and keep them away until the presidential election is past? Well, maybe. At least, only the foolhardy would truly dismiss the possibility out of hand. A quick trip in the Wayback Machine to visit someone you never heard of. Henry Brooks Adams was an American historian, educator, civil servant and chronicler of his times. Born into the job, you might say. His great-grandfather was John Adams, and John Quincy Adams was his grandfather. As a young Harvard graduate, he was secretary to his father, Charles Francis Adams, while the latter was Abraham Lincoln's ambassador in London. After the Civil War, the younger Adams became a noted political journalist, entertaining America's foremost intellectuals at his homes in Washington and Boston. His History of the United States During the Administrations of Thomas Jefferson and James Madison, a nine-volume work, is renowned for its literary style. His posthumously published memoirs, The Education of Henry Adams, won the Pulitzer Prize and was named by the Modern Library as the best English-language nonfiction book of the 20th century. Could there be a more worthy, credible or better born and bred intellectual exponent of the glorious sweep, high mindedness and crystalline philosophical order of the American political tradition? And presented in such elegant prose. Yet one of his most famous epigrams, taken from his memoirs, stands in jarring contrast to his historical and pedagogical pedigrees. It by turn is renowned for being cold, spare and blunt: "Practical politics consists in ignoring facts." Quite the sentiment from a patrician scion reflecting dispassionately on the exhilarating inner workings of America's political arena. A sentiment worthy of a Chicago ward healer or a Tammany boss. It expresses a weary cynicism that, even if offered sardonically, almost anticipates, and is fully concordant with, the mindset our current White House occupant. The tradition lives!

[Public domain], via Wikimedia Commons

Henry Brooks Adams (1838 – 1918). Mailed fist, velvet glove, no illusions.

Maybe Trump really is a better student of politics than he gets credit for. Or maybe he's just a natural. Clearly, the lodestar of his life, from long before he entered politics, has been his unshakable belief that you can outlive anything, no matter how embarrassing, how crushing, how bad it makes you look in the moment, just by, well, outliving it. Because people as a rule have other things on their minds and will forget. Which for Trump is almost as good as forgiveness. But that could prove a bulwark that is weakened over time for two nagging reasons. First, as a bumbling real estate magnate in New York and an Atlantic City gambling impresario, Trump was a side show, slipping in and out of the public consciousness. As president, he's the main event, and elections really do have consequences. It's harder to lose track of his steady stream of transgressions and generally outrageous boorishness. Cable TV has a 24-hour news hole to fill every day, the president's stunts really do leave enduring hurt and visible damage, and he can't shut up about it. He always makes for good copy. It's unavoidable that after a while this stuff gets old and starts sticking to you. The second problem is the opposite of the law of diminishing returns. Armored by an ideologically blinded Attorney-General and his own stubborn indifference, Trump appears (as Barr insists) for the moment to be above the law. But as Mueller alluded, if Trump should lose in 2020, he returns to being just "the Donald," no longer unindictable by anyone's measure. And there are already, outside of the Mueller report and whatever the House of Representatives might cook up, sixteen totally separate criminal probes of Trump's putative corporate and personal misbehavior in various states of progress. And counting. Indeed, the number shows an inclination to be self-propigating. And the way things are going in the world of social networking, private citizen Trump could suddenly find himself deprived of his single best defense mechanism: banned from the likes of Twitter for his excessive prevarication and fantasy. Yikes. See Don run. Run, Don, run.

B. Kliban

|

3/16/19 -- A Great Day for the Irish, Again

|

They've got one in Honolulu, they've got one in Moscow too.

They got four of them in Sydney and a couple in Kathmandu. So whether you sing or pull a pint you'll always have a job, 'Cause wherever you go around the world you'll find an Irish pub. Irish Pub Song, The High Kings, 2013 And, evidently, a parade. That old adage that everybody's Irish on St. Patrick's Day is truer than you might realize. The feast day of Ireland's patron saint is observed with public celebrations in many of the world's major cities, including several you wouldn't necessarily think of as unduly Irish. Herewith, some samplings. New York hosts the world's largest St. Patrick’s Day celebration. More than two million people will watch the parade up Fifth Ave., this year on March 16. It lasts about six hours and features bands, bagpipes, and no floats. The city's parade tradition dates back to 1762; the first marchers were British soldiers. (Well, Irish soldiers in the British military.) You can watch New York's parade atwww.nbcnewyork.com Streaming starts around 11 am. Dublin celebrates St. Patrick’s Day over five days with boat races, an Irish Beer & Whiskey Festival, music and street performances and a parade that attracts about half a million spectators. Major landmarks throughout Dublin, including the Natural History Museum and St. Patrick’s Cathedral, are lit with a green glow for the holiday. In Sydney, the whole city including the famed Opera House turns green for St. Patrick’s Day. The city holds an annual themed parade that dates back more than 200 years. Chicago dyes the Chicago River green for St. Patrick’s Day. It's a tradition that dates back to 1961, when the city's parade chairman saw green dye in the river (used to identify sewage problems) and got the idea to color the whole river. On the Saturday before St. Patrick’s Day, more than 400,000 people gather to watch 45 pounds of environmentally-safe vegetable dye turn the murky river a bright shade of green. Even more spectators gather for a three-hour parade that proceeds from Columbus Drive through Grant Park. The march is televised and streamed locally. Since its inauguration in 1824, Montreal's St. Patrick’s Day Parade has never been cancelled, regardless of weather. The three-hour festivities take place on the Sunday before St. Patrick’s Day and include floats, bands, costumes and a massive replica of St. Patrick, which leads the march. Boston's St. Patrick’s Day parade, a century-old tradition, covers 3.6-miles and lasts about 4 and a half hours. This year they're expecting 122 groups to take part with 24 floats and 27 bands, The Boston Police Gaelic Column of Pipes and Drums and other local bands perform, as well as musicians from Ireland, Spain, Germany, and elsewhere. They expect a million people to show up, in a city with a population of 685,094. Savannah's celebration of St. Patrick's Day includes a parade with horses and floats, a street party on River Street with vendors and live musical performances, and the Tara Feis Irish Celebration, with crafts, storytellers and musical performances. The city also hosts a number of smaller parades and celebrations starting in mid-February. One special event is the William Jasper Green ceremony, which honors the Irish men who lost their lives in the Siege of Savannah. London's annual St. Patrick's Day parade travels a 1.5-mile route from Green Park to Trafalgar Square. An all-day festival at Trafalgar Square includes music performances, a food market, fashion show and film festivals.

|

Munich's St. Patrick’s Day parade dates back only to 1995, but its festivities gain more traction each year. The city shuts down Leopold Strasse for the parade with draws about 15,000 participants. Buenos Aires is not only home to the largest St. Patrick’s Day celebration in South America but is also home to the fifth-largest Irish community in the world. The St. Patrick’s Day street festival takes up 10 blocks along Reconquista Street with music and dancing. Their annual parade, which ends at the Plaza San Martín, features Celtic music and a leprechaun costume contest. Cooking corned beef is pretty easy so long as you have the wit to remember to put it on early. It's little more than tossing a chunk of meat (brisket or round) into simmering water for three hours. They even give you a spice pack with the meat. Cook the carrots, potatoes, and cabbage wedges as you usually would. Just throw them in the same water after your meat's been on for two and a half hours. Potatoes first. Then the rest 15 min. after. They all finish up at the same time, as very good friends.

It's not necessary to bake your own Irish soda bread, although that's pretty easy too. After, it's time for Irish coffee. Coffee, Jameson's (or Tullamore Dew or Bushmills, whatever's on hand), a little sugar and float a dollop of whipped cream on top (out of the can is fine; don't squirt it directly into your mouth). To finish the night off right, try The Parting Glass* (also by The High Kings) music video (on the YouTube list). It will send you off with a tear in your eye. For those still awake and able to get there unassisted, then time for bed. And so, goodnight, sweet prince(ss); may flights of angels sing thee to thy rest. Irish angels. The next St. Patrick's Day is only 365 days off. *The Parting Glass is actually Scottish in origin. It was the most popular leave-taking song in Scotland before Robert Burns supplanted it with Auld Lang Syne in 1788. The Irish appropriated it and turned it into a drinking song. |

3/12/19 -- Plumbing the President's "Darker Purpose"

|

The Tax Reform Scorecard (above) was intended to demonstrate how the White House's dreams for their 2017 tax package were never going to come true.

Almost from the beginning, only the most hard-core Beltway Trumpeteers wasted much oxygen hyping the plan or reciting its touted benefits. Most Republicans stayed mum, hoping the attention would eventually go elsewhere. And it did. The topic barely came up in mid-term election campaigning. Candidates were not eager to take credit for, or even associate themselves with, it. Even Treasury head Steve Mnuchin has gone quiet on the subject. Clearly Websitesammy's original plan to continue the scorecard eight quarters just to bear witness to the ineffectual drip, drip, drip no longer serves any purpose. Everyone's caught on by now. But the thought occurs, is it possible we've missed the whole point all along? Maybe Trump and his cohorts never expected melanges of corporate and high-end tax cuts to really do what they were promising all along. Could the President have been nurturing what King Lear called a "darker purpose"? Many of us thought him not complex enough a political persona for that. But maybe he had something else in mind from the beginning. An old idea near and dear to his fellow Republicans' hearts. Just recently the president sent his 2020 budget proposal to Congress. It features broad spending cuts totaling $2.7 trillion, the exceptions being a 5% boost in defense spending and $8.6 billion for his "Wall." It slashes spending at a host of federal departments and agencies, including EPA, Education and State His campaign promises not to touch Social Security or Medicare notwithstanding, it proposes reducing Medicare spending by $845 billion over 10 years. |

During his 2016 campaign Trump also bragged he'd eliminate the national debt while in office, but his new budget proposal projects it will grow to $31 trillion in 10 years. So, what's the deal? MSNBC's Ali Velshi thinks he knows. And Bruce Bartlett (former Republican) and Austin Goolsby think he's right. Bartlett was a Treasury official in the Bush Administration and Goolsbee, who could never be confused with a Republican, was chairman of President Obama's Council of Economic Advisers. They're convinced it's all part of that long-held Republican dream of rolling back the Democrats' jewel box of entitlement programs, which have been stuck in Conservative craws since the time of Roosevelt. The idea, long held by many Republicans, is that without huge deficits to assail, any attempt to attack such popular programs is doomed to failure. Take a look. Have a listen. Possibly we've all been too hard on this president, thinking him a witless, visionless naif when it comes to conjuring up a financial philosophy on a grand scale. Maybe he, with a litle help from his friends, had a plan all along: strategic, nuanced and long-term in scope. Stripped down to its essence it harkens back to liberal complaints from the '60s, echoed by many and epitomized most elegantly by Gore Vidal: "Socialism for the deserving rich, and free enterprise for the undeserving poor." And if you're one of the multitude stuck in the middle, well, that's a bit of bad luck for you. Okay, so it's a little derivative, but it's still a philosphy. And cherished still by the likes of Mitch McConnell who's been waiting patiently for this moment. Who knew? Maybe he really is a Repbulican after all. |

“ They wanted revenues to fall because they wanted the deficit to rise. Because what they really want to do is cut entitlement programs. And they understand those things are very politically popular. They can only be cut when there is a deficit so large that people are frightened and they feel we have no choice. And that has been their goal for forty years. ”

Bruce Bartlett, Deputy Ass't Treasury Director under G.W. Bush

|

2/6/19 -- One and a Half Robins

|

In his second (and only slightly belated) State of the Union message to Congress, President Trump delivered, as is his wont, several whoppers. To no one's surprise. But what may have been the biggest whopper of all passed like a ship in the night, possibly because the TV commentators reporting on the event don't really know much more about GDP than the Donald does. Stretchers on subjects ranging from "The Wall" to criminal aliens, women in the work force, wage growth, public safety in El Paso, minority employment rates and creeping socialism, in turn, showcased the president's penchant for nonsense, non-sequiturs, misstatements, half-truths, flights of fancy and wild, in-your-face mendacities. But the Fourth Estate was prepared. They'd assembled armies of fact-checkers to red-flag and review, in almost real time, the president's expected stream of suspicious claims and exaggerations. When Trump claimed that economic growth had doubled on his watch, however, he pretty much got a pass all around. A few anchors turned to their economic experts, but those too punted on the claim. It could be they weren't sure how to do the math, GDP being such a recondite matter (quarter-by-quarter percentage differences multiplied by four (to annualize the difference) and then multiplied by a deflator in order to adjust for inflation. Plus, the numbers are in the trillions. |

“ The United States economy is growing almost twice as fast today as when I took office, and we are considered far and away the hottest economy anywhere in the world. ”

But it looks like that's what Trump did, and it gave him a figure nearly (still not quite) twice as large in his favor, e.g., 3.4 vs. 1.8. (Admittedly, using the 3Q '18 GDP figure put him three months out of date. Fourth quarter numbers were delayed, a casualty of the shutdown, but the Atlanta Fed predicts it will be more like 2.7%, less flattering still to the President's case.) Even an undergrad with just a minor in economics could have told the president that this was not a valid way to measure GDP growth in his brief term in office. It's more like choosing a high number for me and a low number for you and seeing how they compare. Oh goody, I win! This is Donald Trump, so it could have been just an uninformed misjudgment. He truly wouldn't know. But this is the State of the Union address, and he has advisors who are real economists. Peter Navarro, Director of Trade and Industrial Policy and the numbers man with Trump's ear these days, may be a little loony, but he's got a PhD in economics from Harvard and taught at UC Irvine. He knows how GDP works. |

"These guys believe that a 350 billion dollar tax cut will stimulate the economy, and they're full of s**t. Because they don't know what stimulates the economy. The economy goes up, it goes down, it goes up, it goes down, it goes up, it goes down, nobody knows why the f**k it happens." (Lewis Black, "Black on Broadway," 2004l)

|

|

|

It's hard to look smart dealing with such abstrusities unless you're truly ready to appear both brilliant and plain-speaking at the same time. Where's Charles Krugman when you need him? The boldest could do little more than acknowledge, yes, GDP had indeed grown more fastly on his watch, adding meekly that maybe Trump shouldn't get all the credit. Then they clasped their hands on the desk in front of them and waited for the next question (which hopefully wouldn't involve long division). Trump's GDP numbers are pretty good numbers, no question, but not wildly out of line with what you'd expect from an economy in the later stages of a long-term economic growth spurt. Since the second quarter of June 2014 the US has enjoyed 20 straight quarters of uninterrupted GDP growth. (This is the second longest recovery on record, someone said.) Numbers even Tom Brady could admire. Trump characterized his "GDP accomplishment" as an "economic miracle," but even an increase of 100% would at best be only near-miraculous. It happens. More to the point, skeptics might ask, what, or more specifically, where was he actually measuring? Ignoring for the moment that quarter-to-quarter GDP can be a volatile number and even two years of a presidential term might not be enough time for a legitimate assessment, let's just try to figure out what point of comparison the President had in mind. GDP growth for 2018 will come in at about 3%, an improvement over any part of Obama's tenure no matter how measured. (2015 GDP grew 2.9%.) But for it to have really doubled, there would need to be some Obama GDP metric of 1.5% or less to compare it to. What would fit that bill and still make for a sensible comparison? What could the President have been thinking? GDP growth in Obama's last year in office was 1.9%. Hmm, close. Almost 60% better for Trump. But not nearly double. Given GDP's quarter-to-quarter volatility, maybe Trump felt such a narrow-term comparison might smack of cherry-picking anyway. So perhaps Obama's last two years compared to Trump's first two. That would produce average annual GDP growth of 2.6% for Trump versus 1.96% for Obama. Ooh, that's worse: only 32% better. Similarly unsatisfactory results come from comparing Trump's two years to Obama's two full terms together or just the whole second term alone. And again, there's the problem of asymmetric comparisons The thought occurs, given that the Donald probably doesn't know much about GDP beyond how to spell it, maybe he simply took his most recent reported quarterly GDP growth figure (Q3 '18) on hand versus Obama's last quarter in office (4Q '16). This, of course, is an apples-to-oranges comparison, looking more at quarter-to-quarter volatility than actual growth. (Which is what GDP is designed to do, by the way: spot and annualize current versus historical growth trends.) |

So do Trump's Chief of Staff, Mick Mulvaney (Georgetown, major in international economics) and Larry Kudlow, Director of Trump's National Economic Council (studied politics and economics in a Master's program at Princeton University's Woodrow Wilson School of Public and International Affairs, did not graduate). So, speaking for the group, this was a knowing lie intended to deceive a gullible audience. But for Donald it may actually have been an improvement on past performance. Last August he made a similar brag about GDP growth under his guiding hand. He claimed then that he had tripled it. So at least he got a little closer to the truth this time. (For the record, the country with the "hottest" GDP in 2018 was Ghana (8.3%) according to the World Bank. In 2017, the title went to Ethiopia at 8.5%. So close.) Some Are Born Great ...

One of Sammy's favorite dictums, used on these pages before, is that presidents don't ruin economies, economies ruin presidents. (Although it could be argued Donald Trump is giving this theorem a serious bench test.)

But by and large the economy is impacted, positively and negatively, by a broad range of forces over which a president can exert little direct control. What's more, consequential decisions that actually could move the economy might very well not show their effects until after—sometimes, years after—he's left office. George H.W. Bush comes to mind. He may have lost his reelection bid to a tax increase he put in place that may have ushered in years of growth during his successor's term in office. Late last summer Justin Fox penned a piece for Bloomberg that examined this same subject and reached some thought-provoking conclusions. His proposal for how to most accurately calibrate GDP performance during a president's term(s) in office was applied to calculations in this posting (although it proved of negligable numerical signifigance dealing with short timeframes). Maybe more significant, Fox provides a different way of approaching the entire impact of GDP growth and its importance in assessing a president's accomplishments as the country's national leader. Fox's piece can be found here: Guess Which Presidents Really Oversaw Economic Booms. The chart below is taken from his story. This is a highly worthwhile article for anyone looking to develop a deeper understanding of GDP and how economic growth plays out over time in our country's progress. In fact, it would be a very good article for the president.  |

In all very numerous assemblies, of whatever characters composed, passion never fails to wrest the sceptre from reason. Had every Athenian citizen been a Socrates, every Athenian assembly would still have been a mob.”

In all very numerous assemblies, of whatever characters composed, passion never fails to wrest the sceptre from reason. Had every Athenian citizen been a Socrates, every Athenian assembly would still have been a mob.”