|

The way things look ... |

|

|

|

|

|

Gallup Wkly: 38% - 1/14/18)

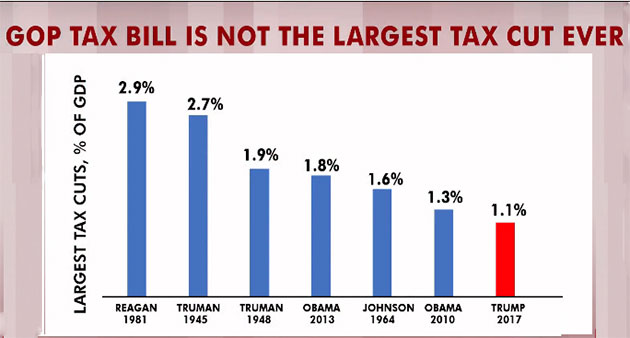

12/22/17 -- 1,000 Words

Source: Committee for a Responsible Federal Budget

12/9/17 -- Bells Will Be Ringing, the Glad, Glad Tune ...

| Need a little Christmas boost to catch up with the rest of the crowd? Visit this year's Christmas Page and find out why you don't feel better about things this year—and what if anything you can do about it. Then memorialize your current attitudinal outlook on the Christmas Spirit Index Gauge. That right there ought to make you feel better. |

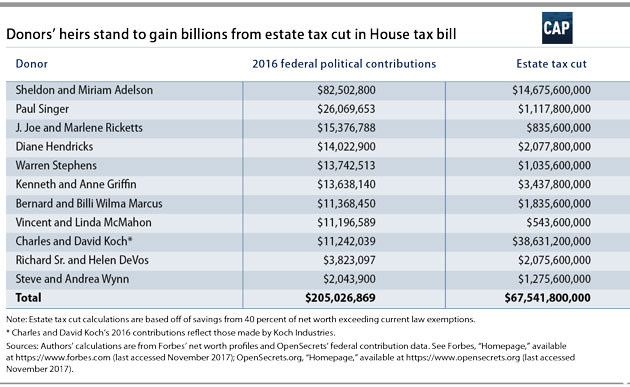

11/19/17 -- 1,000 Words. Any Questions?

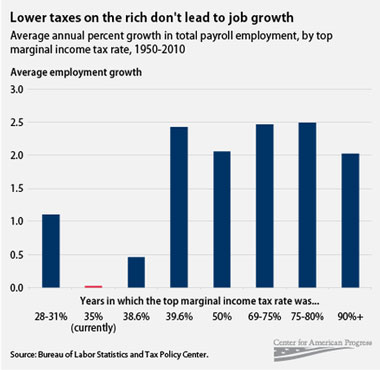

Center for American Progress

11/17//17 -- Chasing Unicorns

|

Take out a sheet of paper and write 500 times, "Anyone who tells you tax cuts pay for themselves is a liar, a fool or a Republican tax strategist."

Congress is closing in on an agreement on the biggest tax reform package since 1986. Or at least that's the plan. Of course, to these guys that doesn't really mean tax reform. It just means tax cuts, generally aimed at higher earners and corporations. There's lots of things wrong with the tax code, but these guys aren't interested in most of them. They're concerned with this country's highest-in-the-world marginal corporate tax rate (30%) and bemoan its unfairness and the drag it puts on economic growth and international competitiveness. The conservative movement has been touting tax cuts for so long economist Charles Krugman characterizes it as an "inward-looking cult," observing, "They know what they know and are impervious to contrary evidence." The energizing idea underlying current Republican thinking is that tax cut beneficiaries will invest the money previously gone to taxes into jobs and expansion, thus stoking the engines of progress. There's really not much evidence that tax cuts spur spending and economic growth all that much. At which point any right-thinking Conservative will interrupt to point to the Kennedy Tax cuts in 1960 , which ushered in a wave of economic growth after the top tax bracket at the time, 98%, was brought down to 86%. Well, never say never. At which point, comedian Lewis Black will pop out of a cake and proclaim, "The economy goes up, it goes down, it goes up, it goes down. Nobody knows why the fuck it happens." And the preponderance of evidence would seem to support Black. Looking at the historical record, the results are so varied and affected by such a complex melange of other influences that it's very difficult to predict what the outcome of any given tax initiative is going to be. What is known is that no one hires just because they have some extra cash. Hiring is a last-ditch activity that follows hard and fast upon someone's realization that they're about to miss out on a profit opportunity because of inadequate productivity and that increased manpower is the only remedy. And then they don't worry too much about the cost of hiring. That can be balanced out later. Similarly, rich consumers don't increase their spending just because they have more money in their pockets. First, that's not how they got rich, and second, there's not that many more things they need or can store until they do. But feeding consumer spending does seem like a worthwhile action if your goal is increasing GDP, which basically is increased consumer spending. Quod erat demonstrandum.

GDP goes up when middle class consumer spending does, because consumer spending comprises 70% of our gross domestic output. Cars, refrigerators, replacement windows, a new winter coat, more dinners out. Stuff like that. Recognition of that fact of modern economic life is what's also behind the unthinkably radical idea of the government just giving everybody a minimum salary. It may not jibe with your personal political philosophy, but that doesn't mean it wouldn't be a way to spur growth. Imagine: Giving away money to the people most likely, out of sheer necessity, to spend it. A fairly immodest proposal. But still probably more plausible than expecting tax cuts to pay for themselves. Because, think about it, no goods producers are going to invest in increasing output until they're sure there's somebody out there with the wherewithal to buy the stuff they make. This from Investopedia: A key question about these proposed tax cuts is, absent complementary cost cuts won't they break us? Won't they just explode the debt, which already amounts to nearly $700 billion? (Yes, it's climbing again.) Maybe. The CBO projects an increase of $1.5 - $1.7 trillion. A key mechanism that tax-cut proponents are relying on for keeping their plans from drowning us in red ink is something called dynamic scoring. That's what they employ to come up with their savings projections and what they want the CBO to employ when calculating the revenue losses the tax cuts would generate. They contend that the cuts will not lose revenue since they will spur economic growth and thus produce enough additional tax revenue to pay for the direct cost of the cuts. And therefore, the CBO should monetize that growth up front and then reduce their estimate of the revenues lost due to the tax cuts by an equal amount. This is the mechanism that Secretary of the Treasury Steven Mnuchin is counting on when he predicts the tax cuts will pay for themselves. During the 1980 Presidential primaries, this was also the mechanism that George H.W. Bush was referring to when he famously accused his fellow Republican, Ronald Reagan, of practicing "voodoo economics." Today many contend he proved right. The deficit ultimately tripled during Reagan's time in office. Generally, academic and economic opinion is that tax cuts could pay for about 15% to 30% of their costs through increased growth. The following from a group called The Committee For A Responsible Budget: A number of economic studies confirm this finding. For example, a 2005 study from Greg Mankiw and Matthew Weinzierl found that tax cuts could pay for between 15 and 32 percent of their initial cost.

|

Other posts on this page ...

Antoine Dominique Domino Jr.

No Offense Intended

Donald of 100 Days

Chuck Berry.

Three Jeers for the New President

A 2014 paper by Bill Gale and Andrew Samwick surveyed existing economic literature and concluded tax cuts might not produce any significant economic growth, in part because they result in higher debt. Finally, a 2005 CBO analysis found the economic growth from a 10 percent cut in individual income tax rates would at best recover 28 percent of the lost revenue and at worst further increase deficits slightly due to the negative economic impact of higher deficits.

The bottom line is that while tax cuts can help accelerate economic growth in some circumstances, they will not generate anywhere close to enough growth to fully offset the revenue losses they create."

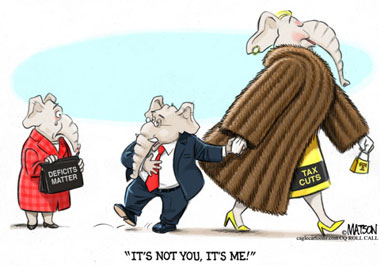

R.J. Matson / Roll Call

Mark Zandi, chief economist at Moody's Analytics, says the cost of the Republicans' proposed tax cuts would add considerably to the federal debt burden, which now equals 75 percent of U.S. gross domestic product. By 2027, Zandi says, that burden would equal 97 percent of GDP with the tax plan and 87 percent without it. GDP growth has been steady, solid and getting stronger. The last two quarters came in at 3% or over. Profits are strong, and companies are sitting on piles of cash. The unemployment rate, at 4.1%, is at its lowest level in nearly 17 years. The rich have never been richer. It's odd that we're even thinking about tax cuts at all in this environment. Remember the deficit hawks? What happened to those guys? Seems like just a few years ago they were everywhere. Is there any way to get them back? Because, the truth is, it seems like we're pointed in the wrong direction. Krugman: You Can Trust Republicans ... to be Republicans

The title of a recent blog entry by Charles Krugman on the Republicans' plans for tax reform: "Lies, Lies, Lies, Lies, Lies, Lies, Lies, Lies, Lies, Lies." The good Doctor of Economics has long had a problem with what he sees as an uneasy relationship between Conservatives and forthrightness when it comes to taxes. But he feels the current push for tax cuts has taken things "... to a whole new level." He says, "Both the depth and the breadth of the dishonesty make it hard even for those of us who do this for a living to keep track." No love lost there. Herewith, highlights of Krugman's ten biggest gripes. Lie #1: America is the most highly-taxed country in the world

This is a Trump special: he's said it many, many times, most recently just this past week.

Lie #2: The estate tax is destroying farmers and truckers

Tales of struggling family farms disbanded because they can't afford the taxes when the patriarch dies have flourished for decades, despite the absence of any examples. Advocates of estate tax repeal haven't been able to come up with a single example at least since the late 1970s. The reality is that only a small number of very large estates pay any tax at all, and only a tiny fraction of those tax-paying estates are small businesses or family farms.

Lie #3: Taxation of pass-through entities is a burden on small business

Most U.S. businesses aren't what we normally think of as corporations subject to profits taxes. They're partnerships, sole proprietorships, and S corporations whose earnings are counted as part of their owners' personal income. Many middle-income households with pass-through entities aren't running businesses and generally derive only a fraction of income from these entities. High-income owners get a lot of money from them but they're not struggling small business people: [They are] doctors, lawyers, consultants or other professionals, even partners in hedge funds or investment firms. Most Americans are in a tax bracket of 15% or less, so even with a pass-through entity, the Trump tax break is worth nothing to them.

Lie #4: Cutting profits taxes really benefits workers

What happens if you cut taxes on corporate profits? The immediate impact is that (duh) corporations have more money. Why would they spend it on hiring more workers or increasing wages? Not, surely, out of the goodness of their hearts —and not in response to worker demands, because these days nobody cares what workers think. Apple, Google, Microsoft, and others derive their profits from technological advantages, brand name, and market power; cutting the taxes on those profits just leaves their owners with more money.

Lie #5: Repatriating overseas profits will create jobs

For tax reasons, corporations hold a lot of money in overseas tax shelters. Tax cutters always claim that lower rates and/or an amnesty will bring that money home and create a lot of jobs. There isn't really a Scrooge McDuck-type pile of cash hidden overseas, ready to be put to work if the taxman will let it. Many of the companies with big overseas hoards also have plenty of idle cash at home; what's holding them back is a lack of perceived opportunities, not cash flow.

Lie #6: This is not a tax cut for the rich

Actually, if you look at the major provisions of the Unified Framework, the big items are (i) Cuts in corporate taxes (ii) Pass-through tax cut (iii) elimination of the estate tax (iv) cut in top marginal rate. All these strongly favor very high incomes— and everything else is small change.

Lie #7: It's a big tax cut for the middle class

All the big provisions benefit the rich, not the middle class. Ending deductibility of state and local taxes and other deductions, actually raises taxes on a substantial number of middle-class Americans. In total, by 2027, according to TPC, 80 percent of the tax cut goes to the top 1 percent; only 12 percent to the middle three quintiles.

Lie #8: It won't increase the deficit

OK, we're looking at big cuts in corporate taxes, elimination of the estate tax, lower rates on high-income individuals, and a massive new tax-avoidance loophole. How can this not increase the budget deficit? The only answer would be if the tax proposal eliminated vast swathes of the existing set of tax deductions, massively broadening the tax base. It doesn't.

Lie #9: Cutting taxes will jump-start rapid growth

Insistence in the magical power of tax cuts is the ultimate zombie lie of U.S. policy discussion; nothing can kill it. There's a lot of money behind the proposition that great things will happen if you cut the donors' taxes. It's difficult to get a man to understand something when his salary depends on his not understanding it. There is nothing at all in [recent] history that would make any open-minded person believe that the Trump tax plan will cause dramatically accelerated growth.

Lie #10: Tax cuts will pay for themselves

Some hidden money may come out of the woodwork and show up as taxable income, even if GDP doesn't rise. But this effect hasn't historically been anywhere big enough to offset the direct losses from lower taxes. Reagan's tax cuts led to deficits, Clinton's tax hike to surpluses; Jerry Brown presided over California's fiscal revitalization, Sam Brownback over a fiscal crisis that eventually prompted the legislature to overrule him and raise taxes again.

For Krugman's unfiltered version, click here. Seat restraints advised. |

10/31/17 -- Trick or Treat

Happy Halloween! Click here for Sammy's annual Halloween message to his grown children. Sammy wasn't going to do this anymore, but they all insisted. Funny, because they've never listened to anything else he had to say.

Happy Halloween! Click here for Sammy's annual Halloween message to his grown children. Sammy wasn't going to do this anymore, but they all insisted. Funny, because they've never listened to anything else he had to say. />

/>

Fats Domino was one of the cornerstones of rock 'n' roll who helped define the genre in the early '50s. He died October 25 in New Orleans at age 89. He sold more records than anyone except Elvis Presley in the '50s. Thirty-seven of his singles made the Top 40, and 11 of them reached the Top 10. Antoine Dominique Domino Jr. was born Feb. 26, 1928, the youngest of eight children. He grew up in the Ninth Ward of New Orleans, where he spent most of his life, saying it was the only place where he liked the food. A musical prodigy by age 10, he combined a rich baritone, a warm, almost conversational crooning style (he sang even sad songs with a smile) and rocking piano work blending rhythm and blues, jazz and boogie woogie. Billy Joel called him, "the man who proved that the piano was a rock 'n' roll instrument." His hits, truly too numerous to list, included "Blueberry Hill," "Ain't That a Shame," "I'm Walkin' " "My Blue Heaven," Hello Josephine," and I'm Walkin' to New Orleans." John Lennon said that without Fats Domino there would have been no Beatles. "Ain't That a Shame" was first song Lennon learned to play. Paul McCartney paid homage, as well, with his Domino-style piano work on "Lady Madonna," which Domino himself eventually covered.

Fats Domino was one of the cornerstones of rock 'n' roll who helped define the genre in the early '50s. He died October 25 in New Orleans at age 89. He sold more records than anyone except Elvis Presley in the '50s. Thirty-seven of his singles made the Top 40, and 11 of them reached the Top 10. Antoine Dominique Domino Jr. was born Feb. 26, 1928, the youngest of eight children. He grew up in the Ninth Ward of New Orleans, where he spent most of his life, saying it was the only place where he liked the food. A musical prodigy by age 10, he combined a rich baritone, a warm, almost conversational crooning style (he sang even sad songs with a smile) and rocking piano work blending rhythm and blues, jazz and boogie woogie. Billy Joel called him, "the man who proved that the piano was a rock 'n' roll instrument." His hits, truly too numerous to list, included "Blueberry Hill," "Ain't That a Shame," "I'm Walkin' " "My Blue Heaven," Hello Josephine," and I'm Walkin' to New Orleans." John Lennon said that without Fats Domino there would have been no Beatles. "Ain't That a Shame" was first song Lennon learned to play. Paul McCartney paid homage, as well, with his Domino-style piano work on "Lady Madonna," which Domino himself eventually covered.10/21//17 -- It Takes a Lot to Laugh, It Takes a Flag to Cry

|

The flag doesn't feel any pain. You can't really insult it or disrespect it. The Supreme Court has said it could be burned, and the flag still won't care. What you can do, evidently, is irritate some people with your behavior, or at the very least call attention to yourself in a way that invites contumely. But that's the whole point of most protest. You're trying to catch their eye. Maybe their minds will follow. Maybe not. The abuse is just the price you pay to find out.

The Supreme Court pretty much guarantees your right to a solemn declaration of opinion and even dissent in public, however annoying your message might be to others, so long as you remain orderly. The first amendment does not directly address itself to protest in quasi-public venues, like stadiums, and the law there seems unsettled, but with football most experts seem to regard it as more of a labor-relations than a first-amendment issue. As protest statements go, kneeling seems like pretty mild stuff—certainly less disrespectful than, say, sneaking off to the men's john for a smoke or the concessions stand for a brew, or even just staying staying in the stands, your hat on your your head and talking your way through the entire song, except when you stop to cheer raucously through the last couplet. If the military really took anthem misbehavior as a personal affront, as the President has tried to suggest, it's a safe bet their first move would have been against the folks in the bathroom a long time ago. There is no law that you have to shut up and pay strict attention when the national anthem is played. We're not that kind of country. It's just a custom. A nice custom, actually. And Colin Kaepernick, quarterback of the San Francisco Forty Niners, didn't seem to be trying to give offense. Quite the contrary, he seemed intent on framing his gesture with quiet and dignified restraint. But he was capitalizing on a high-visibility opportunity to draw attention to a problem he took very seriously: he is vexed that police in some cities seem to shoot an awful lot of black people with no real provocation. Please refer at this point to the known collateral effects of P.T. Barnum's first rule of promotion: it rubbed some people the wrong way, including Donald Trump (well, maybe; this man doesn't reek of patriotism). Why the President decided to make such an issue of it, when the gesture was running out of gas and its chief proponent was out of the league, well, one can only speculate.

Certainly, the moment gave Trump a chance to come down on the right side of love of country, something his Russian proclivities most assuredly were not doing for him. And in keeping with his "Look over there!" modus operandi, turning a spotlight on the anthem protest also served to take our minds off his troubles, including a whole host of substantive problems bedeviling his administration's smooth functioning. Moreover, rather than being a piece of an overall communications strategy, it seems to have been something he just stumbled upon in passing at a rally of the thoughtless in Alabama. And it elicited such an unexpectedly enthusiastic response, he started milking it (even finding room for his signature tag line from his television days: "You're fired!") And he hasn't seen fit to put it down since, despite a fair amount of pushback from a fair number of unlike minds.

Fixating on this cause could result in some undesirable side effects, whether the President realizes it yet or not. For one thing, his rather authoritative tack, elevating uncomely expression over a fairly weighty principal, appears to be doing what Kaepernick himself could never quite succeed in doing: galvanizing black athletes, and white ones too, and people who aren't athletes at all, many of whom were not originally all that enthusiastic about it, around a civil rights issue. |

And in the bargain, by recasting the issue toward the right to protest in the first place, he's arched a lot of backs among a large class of people who don't necessarily want to be lectured to about what would be acceptable forms of complaining about injustice. That's territory they have a long history in, and they know their way around in it pretty well.

In the end, it's hard to believe Donald Trump is going to prevail upon his friends among the NFL owners to make an existential conflict out of this with their labor force, who are highly skilled, not easily replaced and mainly black. One suspects it's a fight the owners are going to quietly duck, not least because it makes them look like plantation owners, overly authoritarian, overly white and underly sensitive on an explosive human rights issue. And then there is this gnawing problem that the law could prove hostile to their side if it got into the courts. These guys hate to lose.

One suspects they'll encourage him in public with some sympathetic lip service and then in private collectively hope his attention soon turns to some other distraction, something less volatile like North Korea or Middle East peace. No sign of that yet, though. The President recently renewed his call that the offending miscreants be summarily fired. Most likely that can't really be done, certainly not on any kind of scale. But even if it could, isn't that basically what they tried to do with Kaepernick? Obviously that didn't work. Professional Sports and Patriotism: Star Crossed Lovers

"The Star-Spangled Banner" became the country's first, and only, official anthem in 1931. It didn't take long for it to find its way to the game. During World War II, after adding sound systems, ballparks started piping it out during the seventh-inning stretch. It caught on. People liked it, and soon it became common to play it at the start of the game. Shortly the tradition spread to football games, too. When the war ended, NFL Commissioner Elmer Layden called for all of the league's teams to continue playing "The Star-Spangled Banner" at games, arguing, "The National Anthem should be as much a part of every game as the kick-off. We must not drop it simply because the war is over." Some critices expressed concern that repeating the spectacle too often would lessen the thrill and sense of pagentry, but they were overruled. In the late '60s, following the civil rights movement, some athletes began to feel that thorugh rote collective participation in the ceremonial pageantry of national anthem performances at sporting events they were unwittingly masking the broad dissatisfaction they felt over perceived racial injustices in U.S. society. During the 1968 Summer Olympics in Mexico City, two black American sprinters, Tommie Smith and John Carlos staged a protest of their own at a medal ceremony. As the U.S. national anthem played, both men turned their backs to the Amercan flag, bowed their heads and raised a gloved fist. They held their pose until the Star Spangled Banner completed playing. The crowd booed lustily. Both sprinters were ordered to leave the stadium and then were suspended from the U.S. Olympics team. Later that year, Commissioner Pete Rozelle issued a directive that all NFL players should hold their helmet in their left hand and cover their heart with their right during the playing of the national anthem. David Meggyesy, a linebacker for the St. Louis Cardinals and a civil rights activist and vocal opponent of the Vietnam War, bowed his head instead and held his helmet in front of him with both hands when the anthem struck up before a game. The following year Meggyesy was benched, although a starter throughout most of his career, and he then retired from football at age 28. Over the years, pregame national anthem ceremonies have often morphed in concept and scope from quaint, utilitarian rituals into elaborate, often militaristic, spectacles. In fact, a 2015 Senate investigation found that the Pentagon was paying for patriotic displays at professional games. Senators John McCain and Jeff Flake (both R-AZ) called the practice of paying sports franchises to honor service members a "boondoggle, wholly unnecessary and a waste and abuse of taxpayer funds." The 2015 Senate report stated that since 2012 the Pentagon had spent $10.4 million on marketing and advertising contracts with most of the professional sports leagues, including the National Football League, Major League Baseball, the National Hockey League, the National Basketball Association and Major League Soccer.

|

Have you no sense of decency, sir, at long last? Have you left no sense of decency? ”

Have you no sense of decency, sir, at long last? Have you left no sense of decency? ”4/23/17 -- Something There Is That Doesn't Love A Wall

|

The greatest "First 100 Days" accomplishment for Donald Trump and the Republicans may well turn out to be avoiding a government shutdown, never mind that they control of both houses of Congress and the White House.

In the immortal words of Walt Kelly's Pogo, "We have met the enemy and he is us." If they should fail, it will be pretty hard pinning that one on Barack Obama. The thing that could screw their effort up might be a failure to agree on preliminary funding for the southern border wall (the one Mexico was going to pay for). President Trump wants that included in the Continuing Spending Resolution (CSR) Congress must soon pass to keep the government operating until they can finalize the FY 2017 budget. The $1 trillion-plus resolution is a can kicked down the road from last year's election season and would cover the operating budgets of every Cabinet department except for Veterans Affairs. (The government is currently being funded by a continuing resolution covering December 2016 through April 28.) Plus, the White House is looking to add about $1 billion to fund preliminary design work for the wall. Against a total cost estimated at anywhere from $20 billion to $70 billion. (Take your pick.) One could argue that such an item shouldn't even be considered in a CSR since it's not really being continued from anywhere. It's brand new. The President is basically asking Congress to green light something for which they've never even seen, much less debated, a conceptual plan. Not even Hollywood works like that. For a wall that no one who will be anywhere near it seems to want and that seems to serve little practical purpose beyond spreading out some walking-around money among some random US contractors (with some random ideas for a wall). So sad. “I will build a great wall -- and nobody builds walls better than me, believe me --and I'll build them very inexpensively. I will build a great, great wall on our southern border, and I will make Mexico pay for that wall. Mark my words.”

But the CSR is really small potatoes as such potatoes go. The wall is only one of several large nuts that will need to be cracked when the politicians finally do get down to dealing seriously with spending plans for the fiscal year starting next Oct. 1. Take rebuilding the military. Or paying for a grand infrastructure plan. And of course tax cuts, for mollifying corporations and the wealthy, who suffered mightily under Obama and for getting our economy going again. And of course, there is health care and social security. Much of this is eyes bigger than stomach sorts of things, reach exceeding grasp, beauty before brains, etc. Not exactly pipe dreams, but certainly missing the larger picture. What is the larger picture? The need to do something about the sad reality that since 2001 basically, we've been doing a large-scale imitation of The Mamas and the Papas living in the Virgin Islands on an American Express card before they came up with that first big hit. The federal government has been putting almost a third of its spending for the last fifteen years on the card, living beyond its structural means and awaiting the arrival of a brighter, more remunerative future. Uncle Sam needs a 40% pay raise just to get back on a pay-as-you-go operating basis. Before we buy another thing. And no, you can't just cut back on spending. There are not nearly enough babies on board to throw to the wolves running behind the sled to compensate for our baked-in annual deficit. In years past, this site has offered little exercises where readers could flex their inner budget hawk, however unrealistically. (The intent being to demonstrate that you can't fix things by trimming around the edges.) Perhaps it might be more constructive this time around to take a more informed, contextual approach, to explore not just where the money is going but how the trend lines in our various spending categories are moving. A better understanding of past performance might guide future budget decision-making. (To give away the ending, the inescapable conclusion for all save the truly ideologically blind is, once again, your government needs more money.) How to raise it is of course a matter for a future posting. (Your author certainly doesn't have a clue.) |

Just to take one instance, the bargain with the devil previously known as the Sequester, with its rigid and unreasonable curbs on military spending (and other discretionary spending as well), has left our armed forces significantly in need of investment and maintenance resuscitation. At least that's the word on the street.The Marines say half of their aircraft are not ready to fly. Naval commanders complain they are not prepared to respond to a major crisis. Sen. John McCain agrees, but then he would, wouldn't he? President Trump has regularly expressed the desire for a beefier, more modern and more deadly military. His secretary of defense recently made the observation that even the military budget increase the White House is seeking won't hardly cut it. Much more will be needed. McCain is thinking around $640 billion. Eliminating the constraints of the sequesters will require bipartisan cooperation. Republicans and Democrats reasoning together. That's how we got it in the first place, although admittedly both sides thought it was such a crazy idea that surely Congress would find some way to agree on a budget before subjecting the country to such nonsense. But they were wrong. But let's not get ahead of ourselves. It is true the money has to come from somewhere. And eventually it will. Let's start by looking at what we seem to think we should be spending based on the historical record, and how those figures have been changing over time. Maybe we'll see some things we don't need to be buying and maybe some things should be buying more of, and even some things that would be nice to have but we need to give up because they're just too rich for our blood. Health care comes to mind.

The time frame for this chart displays spending by function and super-function in 2010 (after we'd begun to emerge from the recession) and shows how those categories have grown since through 2016, the last completed fiscal year. Where might we trim and where might we bolster, while still providing hefty tax cuts to stimulate our struggling economy? Here's your side by side. Look it over. What stays, what goes? What needs to pick up, what needs to slow down? Take a moment. It will make you feel better. Or at least better-informed. So whatever your cockamamie ideas about how to get where we're going, now, just like our elected officials, you'll have some idea of what we've been spending, how it's swelled and (perish the thought) how much more we need to throw at it. Thus prepared, maybe we'll be in better shape to fight with each other than we seem to be now. A little pre-season training so to speak. Before we squat on the mat to the tones of, "Ready? Wrestle." |

Charles Edward Anderson Berry Sr.: 1926-2017

Charles Edward Anderson Berry Sr.: 1926-2017

It is sad that governments are chiefed by the double-tongues.”

It is sad that governments are chiefed by the double-tongues.”2/22/17 -- The Natives Are Restless

|

Americans first began with a relish to protest their incoming presidents in 1829 when John Quincy Adams, our sixth president, refused to attend the inauguration of his successor, Andrew Jackson, as did many congressmen and senators.

(His father, John Adams had chosen not to attend the inauguration of his successor, Thomas Jefferson, but that was mostly because he was simply dying to get the hell out of Washington. He had spent large parts of his one term in office conducting the affairs of state from his home in Quincy, MA.) Quincy Adams/Jefferson was, if you can imagine, a far nastier contest than Trump/Clinton: Jackson's wife Rachel fell ill and at length died after suffering through a torrent of viscious, unrelenting attacks against her virtue and character. (Andy never forgot. Nor forgave.) Inaugurals are supposed to be celebratory affairs not particularly marked by angry demonstrations. But through the years there have been ample and notable exceptions that served to emphasize the nation's differences rather than its commonalities. They haven't all brought us together. In the run-up to Donald Trump's Presidential inauguration, The National Park Service granted demonstration permits to at least 28 groups. They were expecting more than 350,000 protesters in all, including about 200,000 for the "Women's March on Washington" planned for the next day. The latter drew approximately 2,000,000 by some third-party estimates, dwarfing the crowd that had gathered to watch the swearing-in, much to the new President's chagrin. Most of the demonstrations were orderly, but six police officers were injured and 217 protesters arrested in several ugly street clashes in downtown Washington. Police in New York, Dallas, Chicago, Portland and Seattle arrested scores at demonstrations in those cities as well. Protests also took place beyond America's borders in Australia, London, Hong Kong, Berlin and the West Bank. In another form of protest, one-third of House Democrats boycotted the inauguration entirely. Anti-Trump forces may have been heartened by this outpouring of opprobrium, but the truth is the day wasn't that much out of the ordinary for a US Presidential inauguration. Some cite the 1853 swearing-in of Franklin Pierce as the first inaugural to draw an official protest, by a group of unemployed workers.

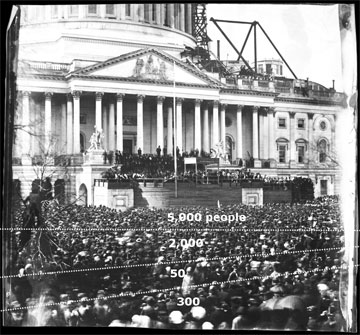

Wilson, 1913, East Portico. Obviously, front-burner issues present greater incentives for crowds to show up and grab some of the spotlight, even if that issue has little actual direct connection to the president-elect. When there's nothing going on the crowds are less inclined to turn out. After all, January in D.C. is cold. The day before President Woodrow Wilson took office in 1913, as many as eight thousand women suffragists marched down Pennsylvania Avenue in what one inaugural historian said was likely the first large-scale inauguration protest. But Wilson wasn't the target. He supported the women's suffrage movement, if not overly enthusiastically, and worked for legislation to grant women the vote. Which was stronger support than that offered by many. James Bendat, who wrote the book Democracy's Big Day: The Inauguration of Our President 1789-2013, said the women, who had a parade permit, were "pushed, spat upon, and beaten up" by irritated onlookers. The incident led to the firing of the capital's police chief. Four years later, the women were allowed to march in the inaugural parade, for the first time. Women gained the vote in 1920. From the '20s to the '60s inaugurals tended to be orderly. What with three big wars, the death of FDR, the stolidity of the '50s and the can-do idealism born of Kennedy and Camelot, people weren't in a protesting mood. Noteworthy, during that period, Roosevelt's 4th swearing-in took place on the rear balcony of the White House, and Kennedy's famously and stirringly memorable inaugural address was one of the quickest on record. Good feelings all around.

Kennedy, 1961. "Ask not what your country can do for you..." Under 14 minutes, fourth-shortest inaugural address in history. Richard Nixon, inheritor of a hugely unpopular war, would not be so lucky. Americans had learned the art of protesting by the end of the '60s. They didn't just march. Anti-war demonstrators threw burning miniature flags and stones at police during Nixon's 1969 inauguration. According to The Boston Globe, about 500 people participated in the protests. The paper noted it was first time in recent history that an inauguration fomented such a large public demonstration. And Vietnam wasn't even Nixon's war then; he ran for office as the man with the plan to end it. According to another news report, as many as 5,000 demonstrators converged on a site where a reception for Vice-President-elect Spiro Agnew was being held, and U.S. Park Service police used horses, for the first time in a Washington demonstration, to drive them back (with mixed results). Firecrackers were hurled at the horses, which reared up and then began dropping manure. Agnew's guests began arriving and had to walk, in their formal attire and finery, a red-carpeted gauntlet from the street to the venue, while enduring a steady barrage of shouted epithets, hurled rocks and, yes, steaming handfuls of horse manure. Resourceful mob. As police attempted to move the protestors back, they lost control and, as will happen, began clubbing people. Several protestors were trampled by the mounted horses. One over-enthusiastic officer charged wildly into the crowd, on foot, before suddenly and belatedly realizing he had surrounded himself with demonstrators, with no other officers in sight. They proceeded to remove his helmet, gun, badge, and nightstick and then began pummeling him with their fists before some of his fellow officers realized his plight. |

Nixon, 1969. Before things turned ugly for Agnew. The situation was then different again in 1973 when Nixon won reelection and the war was still dragging on. Not only was he greeted with unruly inaugural crowds, but by then the war was his and the demonstrators' feelings were even more pointed and more personal. Plus, by this time, anti-war protests in America had evolved into highly sophisticated undertakings. The war issue helped draw over 25,000 protesters to Nixon's second inaugural, resulting in dozens of arrests. When Ronald Reagan was sworn into office in 1981, there were some protesters in Washington led by the National Organization for Women, but they did not have a major impact on events. The freeing of the Iran hostages was the news of the day, creating a decidedly feel-good national moment. In 1985, a snowstorm and cold snap resulted in the cancellation of the usual outside ceremonies. Dutch: born lucky.

Reagan, 1981. Happy days are here again. George W. Bush was greeted with notable demonstrations in both 2001 and 2005, the latter focused on his decision to invade Iraq; the former on the manner of his victory over Al Gore and his relatively low, for an incoming president, public approval ratings. Earlier cultures felt there was little to be gleaned of much significance from the beginning of a person's journey. They were more inclined to commemorate their notables' deaths than their birth dates. Preferring to take stock at a point where they felt better able to assess the worth of a man's or woman's contribution to posterity. They saw the real story, as it were, as being more in where you finished up than in how you started out. Donald Trump could perhaps take some comfort in such a perspective and fret less about the magnitude of his victory and the size of his crowds. In the great scheme of things such measures won't really amount to enduring accomplishments, even if successfully embellished. If he's learned anything from his first thirty days in office, our new President should realize by now that his future reputation is not going to hinge on accomplishments achieved before he actually took office. Take the case of Abraham Lincoln. Seven states seceded from the Union upon his election. How's that for a protest? Lincoln's procession to the Capitol had to be surrounded by heavily armed cavalry and infantry, providing an unprecedented amount of protection for the President-elect as the nation stood on the brink of an actual war with itself.

Lincoln, 1861. Large crowd for its day, not altogether friendly. His inauguration was the first time Lincoln appeared in public with a beard, which he had begun growing only after being elected to the presidency (supposedly on the advice of a little girl). This effectively made him the first president to have any facial hair beyond sideburns.) In time, Lincoln would also become the first president to be assassinated by political opponents. And yet, in time, notwithstanding his truncated term in office, he came to be looked upon most favorably by both professional historians and the general public. His reputation endures to this day.

Size matters?

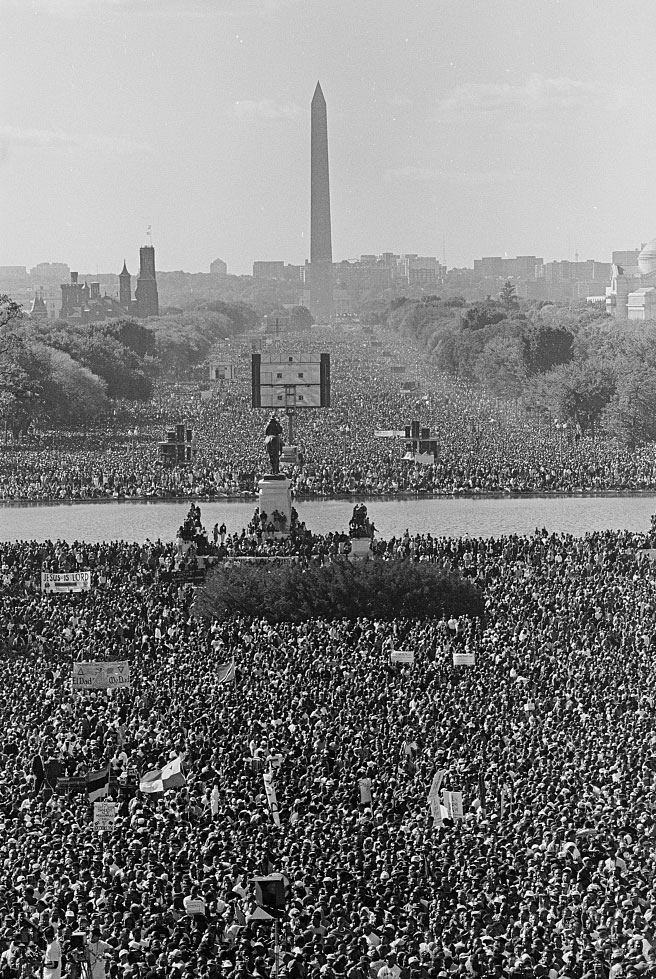

The National Parks Service stopped issuing official crowd estimates in 1995 after "The Million Man March" organizers accused the service of low-balling its estimate of the turnout for their event.

The Park Service's number: 400,000, significantly lower (obviously) than March organizers had in mind. (ABC-TV-funded researchers at Boston University eventually made an estimate of 837,000 with a 20% margin of error.)

How many people can you count in this picture? Million Man March, 1995 Whatever the actual number, the Parks Service concluded it was way too many people to have mad at you and exited the crowd-size estimating business. Today estimates are done by private research organizations and educational institutions using a variety of techniques: aerial photo analysis (hard in D.C.; airspace restrictions), satellite images (weather permitting), mathematical area and density map analyses and, quite naturally, computer algorithms and even artificial intelligence. Still in all, it remains a bit of an art. Crowd estimates for recent inaugurals:

|